The future of 5G – four lessons learned

During a recent webinar poll, 60% of communications service providers (CSPs) said they don’t have a 5G plan yet or haven’t started executing it.

Isn’t 5G now entering early commercial viability?

Well, yes, in some markets (think China and the U.S.) 5G has been a priority for a while and rollouts are now underway. But other regions (think South Africa and Latin America) have not yet begun planning their 5G evolution. While CSPs’ need to cut costs and increase revenue will eventually push 5G into the mainstream everywhere, this isn’t necessarily a linear evolution globally.

It’s fair to say that getting to 5G commercial reality is proving to be a fluid process, both helped and hindered by the events of 2020. Let’s look at some of the lessons learned so far, and how these might help to ensure a smoother road to next-gen mobile success.

1. Choosing the right location and use cases for 5G is challenging

In another webinar poll, 80% of CSPs put prioritization decisions for 5G site rollouts at the top of their planning and launch challenges. Lack of certainty around technology factors like availability of 5G-compatible handsets mean it’s hard to know where to launch 5G and for which types of customers or service uses cases. Which sites should have fixed wireless access (FWA), for example?

While it’s impossible to account for all post-launch factors, one thing CSPs can do is get pre-launch right by maximizing 4G performance, stability, capacity and coverage to mitigate potential post-launch 5G problems.

“Even 5G-specific services like VoLTE will continue to rely on 4G networks,” pointed out Xanthos Angelides, Product Line Manager at EXFO.

There is a lot of power in understanding where and how high-value customers connect to the network; with this knowledge, it’s possible predict where 5G services are likely to succeed and what types of services—like IoT-related connectivity or FWA—will generate the most revenue.

Let’s look a bit more now at why 5G success depends on the quality of 4G networks.

2. Getting 5G to market fast requires a hybrid architecture approach

Operators need 4G networks built out for greater capacity to form the backbone for 5G non-standalone (NSA)—which by its very nature depends on hybrid technologies and infrastructure to work.

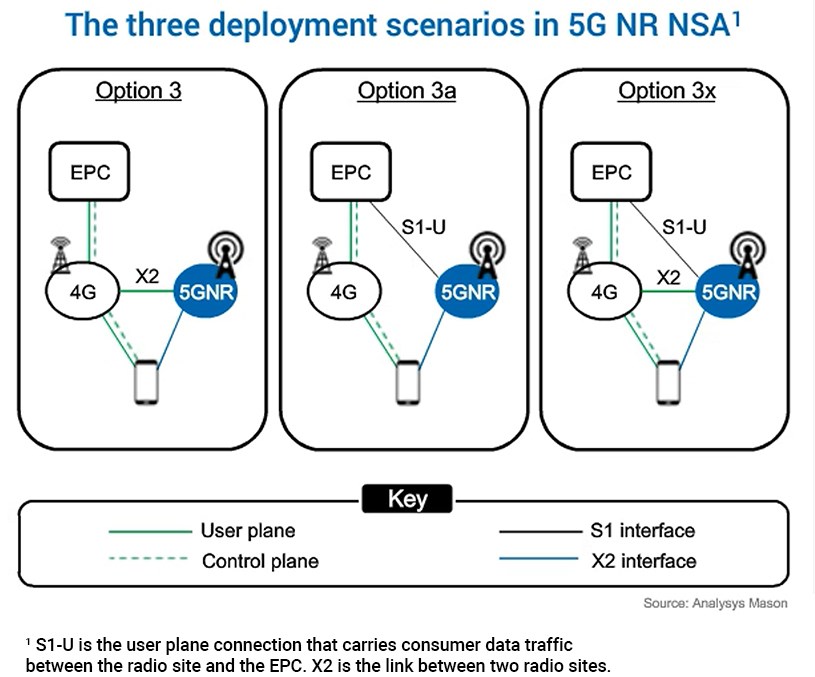

Roberto Kompany, Senior Analyst at Analysys Mason, said there are three main scenarios for 5G network deployments. Those scenarios are based on 3GPP 5G NSA specifications designed to accelerate 5G time-to-market by making it possible to integrate 5G radios with 4G base stations using the 4G core.

The most common among these (option 3x, shown below) is having the user plane connection go straight from 5G New Radio (NR) to the core, while the control plane signaling goes through X2 to the 4G base station and then to the user. This gets around the problem of proprietary X2 interfaces, freeing up the operator to use more than one vendor, among other benefits.

How quickly the RAN can be virtualized also plays a key role in the launch of both 5G NSA and 5G standalone (SA). But, as experience shows, the drivers behind virtualization have changed.

3. New use cases, not cost-cutting, prove to be the real driver for virtualization

The first generation of virtualized RAN networks is complete and it turns out they are not delivering the CAPEX and OPEX benefits originally envisioned.

“Virtualizing the RAN has proven to be a lot more complex than virtualizing other network domains, such as the packet core,” Kompany said. “So, the packet core is further along the road to virtualization than the RAN.”

There are various technological reasons why this is so, but another factor is that more focus is now being put on increasing revenue and improving user experience, in addition to or rather than cost-cutting. Business growth is still the end-goal, but the method to get there has changed and so has focus on virtualization as a means to that end.

Eventually, Kompany said, CSPs will reach the point of ‘full RAN virtualization’—including central and distributed units and fronthaul—but the reasons for getting there are less directly about reducing total cost of ownership (TCO) and more about enabling new use cases.

“A virtualized network will allow new use cases to be built in a more dynamic fashion so that the operators can actually get to those new revenue-generating use cases that they want,” he pointed out. “That might be low latency for a smart factory, or mobile broadband for the consumer segment. These use cases require network slicing and an open interface virtualized RAN.”

Those capabilities are especially crucial for breaking into the enterprise market, which is largely recognized as the incremental revenue opportunity in the 5G era.

4. Enterprise services are the most lucrative 5G use case for operators

In another webinar poll, 50% of operators said support for new revenue-generating enterprise services is the most important business driver for next-generation network deployment. Only 17% put support for new revenue-generating consumer services first.

The split between enterprise and consumer services is not very surprising: the market for consumer mobile services is saturated in most regions. Operators are naturally looking for new sources of revenue and expect to find it with network services geared to enterprises.

To cash in on the enterprise market broadly, operators need to understand the specific requirements for a variety of disparate vertical industries. Manufacturing needs something different than healthcare, for example, and energy production has yet another set of requirements. Deploying the most suitable combination of private and hybrid networks is also key to delivering these use cases.

Watch the webinar linked below for an in-depth look at the topics discussed here, including stages of RAN virtualization, the technicalities of 5G post-launch, CSPs’ plans for dynamic specrum sharing especially for the enterprise market, and how EXFO’s Nova RAN and Nova SensAI solutions provide much-needed visibility into legacy and next-generation 5G networks.