Mobile private networks: 4G was the learning phase, 5G is the growing phase

In a previous blog post we highlighted the importance of mobile private networks (MPN), particularly the opportunity it presents for mobile network operators (MNOs) in the form of new revenue streams and the business benefits it will enable for industries. This post will discuss the specific technologies required with MPN architectures.

SLA vs best-effort

The n°1 challenge for operators is implementing an SLA-based approach, where operators guarantee an agreed-upon level of quality for MPN customers. This implies that MNOs need to track performance over time by monitoring key KPIs and react quickly when a degradation occurs, under pain of paying penalties.

DECOR and 5G SA: advantages and drawbacks

3GPP introduced technical enablers to aid in the deployment of MPN, offering multiple possibilities to combine public and private resources to finally deliver the right service with the expected quality. For a more information, please read the blog entitled 'Private 5G networks for connected industries.'

Let’s take a look at different 4G and 5G standalone (SA) architecture scenarios including the challenges associated with each scenario.

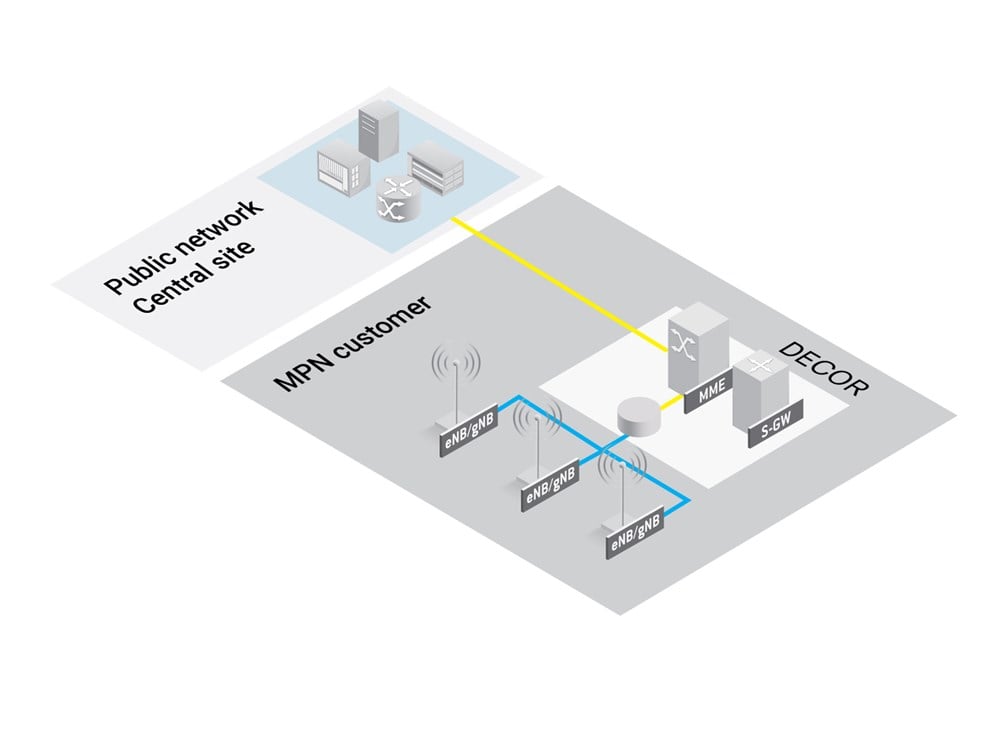

DECOR

In 3GPP Release 13, dedicated core network (DECOR) sets the foundation for early MPN deployments. By deploying some core network functions (MME, S/PGW) at each MPN customer premise, the operator can set up a dedicated network for each MPN customer. This version was slightly improved in Release 14 with eDECOR.

- 4G (e)DECOR has the advantage of being already available and therefore can be deployed today. However, it comes with constraints. Deployment of network CORE resources at customer premises complexifies the model.

- Operators must agree with their MPN customers concerning the installation of hardware (HW) resources on their premises. This further reduces the flexibility to perform any physical modification or intervention, adds CAPEX to the economical equation and raises OPEX when it comes to performing operations onsite.

- The limited hardware resources at MNP customer sites also adds some constraints on the monitoring solution to be deployed. The type and quantity of data sources available for 4G (e)DECOR network functions are key to providing a clear view of the QoS delivered to the MPN customer. For example, the S1-C interface is a key interface to monitor with a passive probe as it provides metrics related to accessibility or reliability as well as useful, detailed information for the purposes of deep investigation. When monitored by a passive probe, the user plane (accessible from the serving gateway or SGW) is also a powerful data source that provides metrics on real quality of experience. Some active tests can also be performed locally to constantly verify integrity of the transport link and of the main services. In each of those cases, HW resources must be reserved at MPN customer sites in order to deploy the correct probing solutions.

- The first services that will be delivered to MPN customers are focused on mobile broadband (MBB/eMBB), where it will be difficult for operators to differentiate themselves from the competition. Consequently, this will limit the revenues they can expect to realize.

- 4G (e)DECOR is using a mix of private and public network resources. Although 4G (e)DECOR-based network functions (e.g., MME, SGW) are dedicated to each MPN customer and therefore operators can manage those resources in a way to guarantee a specific level of QoS, it is not the case on network resources that are shared with the consumer market. At the end, it is difficult to guarantee a specific QoS end-to-end.

- In the end, 4G (e)DECOR is a technology that offers the opportunity to deliver eMBB services to MPN customers but all the constraints it introduces are making the business case uncertain.

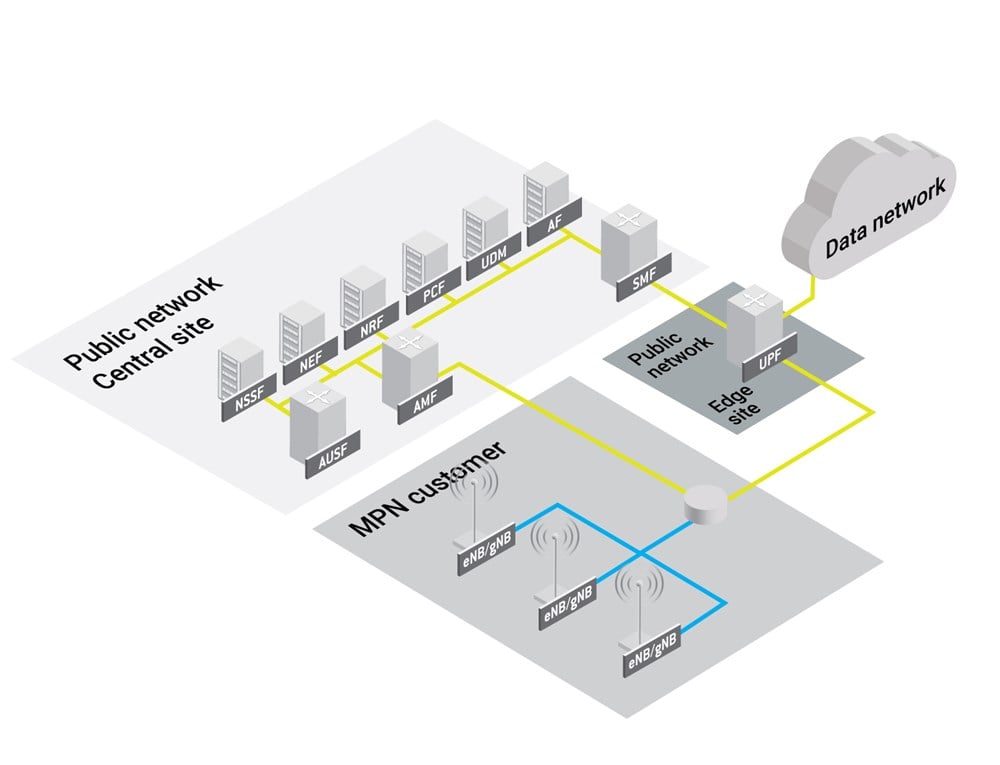

5G SA

With 3GPP Release 15, 5G SA brings new enablers that will greatly contribute to the deployment of MPN offerings and remove some constraints and limitations linked with 4G (e)DECOR architecture. Namely the network slice will become the key enabler for guaranteeing a specific level of quality for each service offered to MPN customers. In addition, other enablers like cloud-native architecture, or mobile edge computing (MEC) will bring new benefits. These benefits include deploying network functions at the edge of the network to deliver ultra-low latency services, deploying a cloud-native architecture to drastically reduce the OPEX of an MPN solution.

- 5G SA has been natively designed to support ultra-reliable low latency communication (URLLC) services. It represents a real opportunity to develop the business of MPN but, as with any new technology, it also comes with new challenges:

- On the one hand, 5G SA offers the possibility to develop services like autonomous cars and remote surgeries—services that require mission-critical SLAs—thus opening the door to new business opportunities. On the other hand, many 5G SA services demand a very high quality of service, meaning that operators must react very quickly in the case of an SLA breach and work to reduce mean time to repair (MTTR) levels accordingly.

- Operators need increased visibility of KPIs—and in real time—coupled with the availability of powerful tools that can help to determine the root cause of issues. This raises the question of which data sources are best suited to provide this full visibility and which service assurance tools can help operators with these tasks.

- 5G SA reduces the number of network functions required at MPN customer premises. This is a real benefit as compared with 4G (e)DECOR architecture as it removes constraints on remote operations and lowers the cost of installing HW at customer sites. Indeed, local mobile management entities (MMEs) and SGWs are replaced by 5G core network functions (5GC NFs) that will be located at central sites. This simplifies the monitoring architecture as additional probes do not have to be installed at the MPN side.

Current technology based on 4G EPC makes it possible for operators to launch their first offers for private networks. This is an opportunity to target key enterprise accounts and to learn how to handle such offers. But 5G SA is the technology that will allow operators to deploy MPN on a massive scale and offer the value-added services that can generate high revenues. In both cases, a robust monitoring solution will be key to assuring the right level of service per offering. Monitoring will have to be considered during the early phase of the offering definition, including the design of the technical solution and the evaluation of the business case. With 4G DECOR-based architecture, operators can get away with compromising on service assurance by reducing the data sources monitored or by choosing the least expensive (and least effective) monitoring solutions available. This will no longer be possible with 5G SA where failure to deliver on mission critical SLAs will be very detrimental to an operator’s business. Operators will need to rely on real-time, automated service assurance including early detection of issues and automated root cause analysis.

In an upcoming blog post we will discuss the data sources that are best suited to assure an MPN service.